Investors continue to seek guidance from Warren Buffett’s renowned investment philosophy, which is based on value and long-term growth, as 2024 draws to a close.

Even though Berkshire Hathaway (NYSE: BRK.A, BRK.B) made news by cutting large holdings in Apple (NASDAQ: AAPL) and Bank of America (NYSE: BAC), Buffett’s strategy of finding and hanging onto “forever” stocks is still at its heart.

Two exceptional stocks from Buffett’s portfolio offer investors looking for steady and alluring returns appealing prospects as the fourth quarter draws to a close against a backdrop of economic uncertainty.

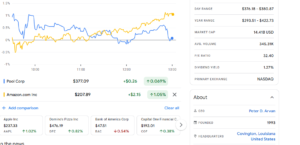

Pool Corporation’s stock (NASDAQ: Pools)

One significant increase to Buffett’s holdings has been Pool Corporation. With a 2.85% year-to-date (YTD) fall in 2024, the stock has lagged the overall market; however, recent events indicate a potential turnaround.

The stock rose 7.6% after the company’s Q3 results report, which was made public on October 24, surpassed forecasts. Despite a 3% year-over-year decline in overall sales due to a slowdown in pool construction, this recovery was propelled by strong private-label chemical sales and steady demand for necessary maintenance items.

Notably, Pool exceeded Wall Street projections by 3.5% and produced adjusted profits per share (EPS) of $3.27 while maintaining a consistent gross margin of 29.1%.

Buffett’s purchase of 404,057 shares at a $152 million price as of September 30, 2024, shows his faith in Pool’s long-term prospects. The investment appears to be well-timed, notwithstanding a minor drop in valuation to $146 million by mid-November.

POOL is currently trading at $377, up 3% in the last five days and 4% in the last month, indicating that momentum is increasing.

Pool Corporation presents itself as a viable recovery option for 2025 with creative efforts like its Pool360 technology and an emphasis on vital product demand.

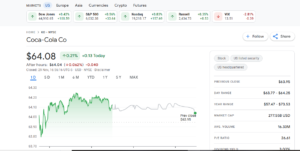

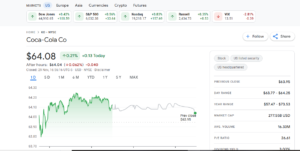

Could the Coca-Cola stock boom be made or broken by Warren Buffett?

The 13-f filing for Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A, BRK.B), which is anticipated to be made public in mid-November, is one impending event that is probably going to have an impact on the future movements of KO stock.

For many years, “The Oracle of Omaha” has held stock in the massive beverage company. With 400 million shares and a 9.1% stake, Coca-Cola was the fourth-largest asset in his portfolio at the end of the second quarter of 2024.

Although KO stock’s future movements are unlikely to be affected by a halt or a slight rise in ownership, the soft drink’s shares might likely face severe challenges if Buffett signals a loss of confidence by selling off a sizable portion of the shares.

The stock of Coca-Cola (NYSE: KO)

A mainstay of Buffett’s holdings, Coca-Cola consistently produces growth and stability. The company continues to be a top choice for income-seeking investors because to its 3.03% dividend yield and an unparalleled 62-year history of continuous dividend increases.

Near-term difficulties still exist, though. A drop in unit case volumes and a dependence on price increases to fuel revenue growth were emphasized in Coca-Cola’s most recent earnings report. Additionally, considering Coca-Cola’s substantial global exposure, the strengthening U.S. dollar poses a currency risk.

Notwithstanding these obstacles, the company’s forward price-to-earnings (P/E) ratio indicates that it is still reasonably valued, which makes it a desirable option when the market declines.

Coca-Cola’s stock is currently trading at $64, down 1.8% over the last month but showing a slight 1.8% rise over the last six months. Coca-Cola’s solid financial sheet and shown durability strengthen its reputation as a dependable long-term investment, despite the likelihood of short-term volatility.

These two stocks stand out as the finest illustrations of Buffett’s consistent investing strategy as investors prepare for 2025: identifying value, placing a wager on longevity, and hanging onto the stock for the long term.

Directly purchasing Berkshire Hathaway stock may also offer risk-averse investors diversified exposure to these and other Buffett selections.

featured today photo.

1 thought on “2 obvious Warren Buffett investments to make in 2025”